The Gartner Hype Cycle is well known to seasoned investors. It defines five phases of a technology’s life cycle – from innovation trigger, where a technology breakthrough is heralded by proof-of-concept and hype (but no viable products), through Beta testing of products, and then finally mainstream adoption.

Most stories are about the start and the success at the end, but the crucial inflection point is the phase in the middle ‘the trough of disillusionment’ that no one talks about.

The Trough of Disillusionment

The trough of disillusionment is when the entrepreneurs learn from the early prototypes and enduser feedback, and realise that significant investment is needed to get them to a viable product. Often they will need to pivot and reposition their technology in the market and develop a new business model.

Unfortunately, this phase comes at a time when the early investors are starting to lose patience and the technologists and scientists behind the innovation are starting to look for the next shiny thing. This leaves the founders in a balancing position between concentrating on the technical challenges of a disruptive technology, keeping existing investors happy, while chasing the next round of funding, and considering the business model that will make the innovation viable.

Role for Corporate Venture Capital?

In the UK, the companies that are particularly vulnerable are ironically those that have benefited early from government grants and funding, as this is often directed at novel innovation that is ten years ahead of the market. These companies then require scale-up money at a time when the government considers that the commercial sector should take up the slack but the technology is still unproven.

Soft-starts – where a corporate covers the overheads and spins out the technology when it is near market – have traditionally fared better and Corporate Venturing can provide other types of startup with similar support and benefit from their innovation.

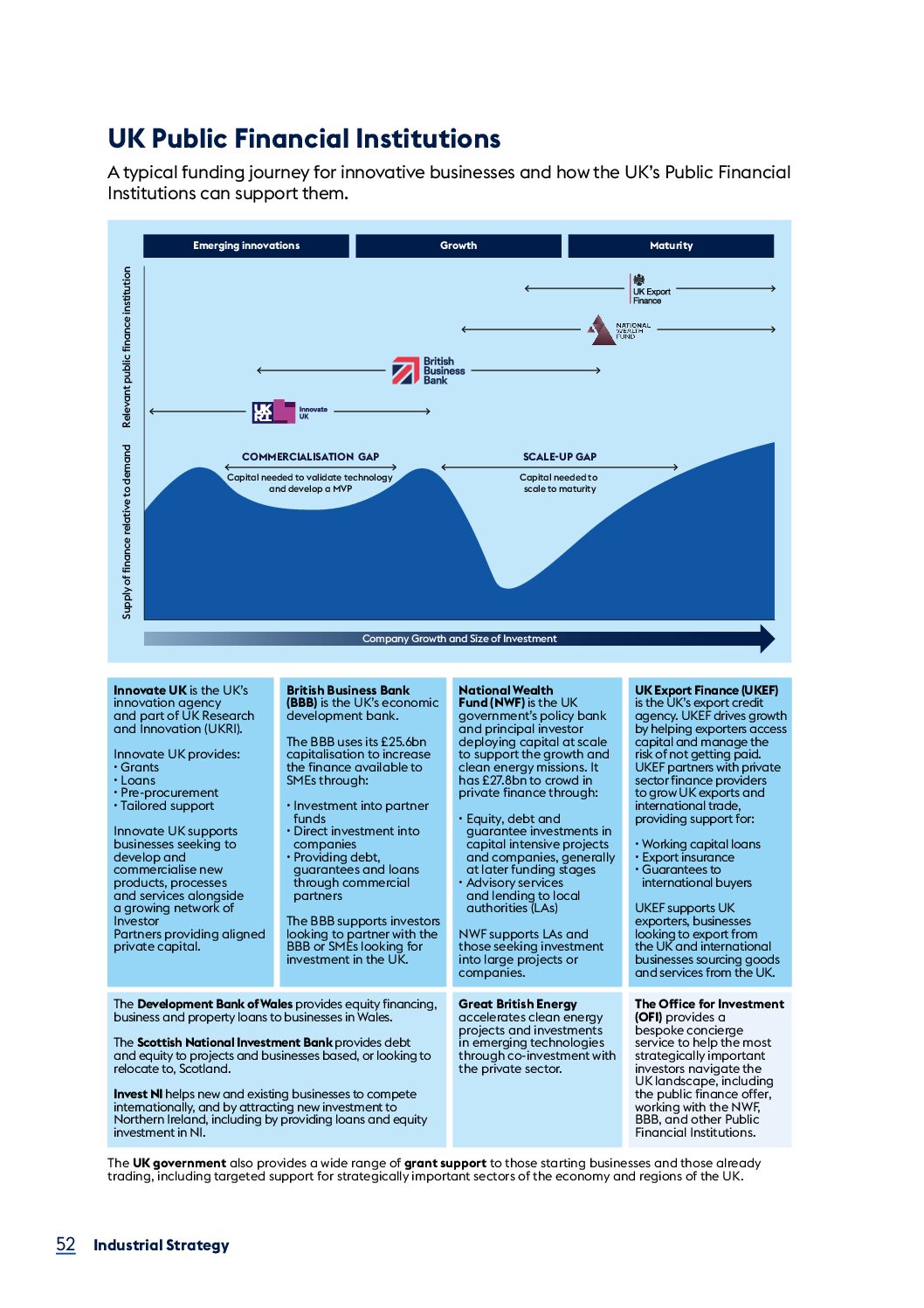

The UK government has acknowledged this challenge in the UK’s Modern Industrial Strategy 2025. This includes the role of the British Business Bank, which was set up to encourage more investment from UK pension funds into innovative companies.

Corporate Venture Capital (CVC) in transition

Corporate investment is a crucial component of the innovation ecosystem but as Maija Palmer reports from the GCV Symposium the corporate venture sector is in a time of transition as companies consider how best to benefit from their innovation arms.

Corporate venture capital (or CVC) is a subset of venture capital (VC) and a few years ago looked very similar. But high interest rates and low returns have meant their purpose is being questioned.

A particular change is the length of the runway speakers at the conference said that startups now need up to three years of funding compared to 18-24 months in the past and investors need longer time horizons for investment cycles.

Awareness of disruption innovation

The intention is that the CVC invests in technologies and companies that are relevant and beneficial to the parent group. As well as finance the business can also access the expertise and network of the corporate group and this can be hugely helpful for a start-up.

In return the business offers market insight, market reach or innovative technology. By having a CVC the corporate can be kept aware of successful and disruptive businesses and benefit from:

- Market sensing – different perceptions bring fresh insights

- Channel co-operation – ecosystems need to evolve to support sustainable businesses

- Technological knowledge and specialist skills

CVC strategies

The conference heard from heads of strategy from GC, the Thai petrochemicals company and technology company ABB and Channel 4 Ventures and Standard Chartered bank.

They were adopting very different strategies:-

- Centralised – GC has centralised the CVC team and given it a strong strategic focus

- Integrated – ABB has decentralised and integrated with three business divisions, increasing the rate of interaction with the portfolio

- Services for equity – the corporate provides specialist services – manufacturing, logistics – in return for equity

- Venture building – corporates found and grow internal startups, creating opportunities to transform the core business in future

- Spinout – the CVC is outsourced to service several corporates, creating knowledge within the ecosystem

More information

Gartner Hype Cycle – Gartner’s clients use Hype Cycles to get educated about the promise of an emerging technology within the context of their industry and individual appetite for risk.

Maija Palmer is the Editor-in-Chief at Global Corporate Venturing

Video presentations from the GCV Symposium are available.

The Global Corporate Venturing (GCV) Leadership Society helps investors navigate the dynamic innovation and investment landscape.