Food and packaging technologies are racing through new norms; driven by consumers demanding healthier, cleaner, and more diverse options. Today, the industry is fueled by rapid advances in technology, climate concerns, geopolitical developments, and restless shoppers.

This in turn makes the mandate for R&D leaders clear: innovate, or risk being left behind. So, why do many teams struggle to do this in a continuum, at scale?

Sunanda Jayanth spent years at Frost & Sullivan advising Fortune 500s on tech-driven growth, she is now Head of Marketing at GetFocus, an AI start-up that uses insights from patent registrations to provide technology forecasts.

Here she gives her analysis on why companies are failing to innovate at scale and argues that continuous technology foresight will help innovation managers to overcome this challenge.

The modern innovation paradox

Today R&D teams have access to more information about emerging technologies than ever before, yet they struggle more than ever to act on it decisively. According to BCG’s Build for the Future Survey, 79% of C-suite executives in the consumer-packaged goods (CPG) sector rank innovation among their top three priorities for driving growth and mitigating risk.

Yet Mintel’s Global New Product Database shows that for the first five months of 2024, just 35% of global CPG launches are genuinely new products—the lowest proportion recorded since tracking began in 1996.

The very abundance of data that should accelerate innovation has become the bottleneck.

What’s happening behind the scenes is that technology is advancing faster, consumer demands are shifting quicker, and regulatory requirements are tightening across multiple markets simultaneously. But most R&D teams are still using the same quarterly planning cycles and ad-hoc trend spotting approaches they used a decade ago.

Consequently, teams that should be leading innovation are drowning in possibilities, paralysed by choice, and defaulting to gut instincts when they should be making data-driven decisions.

According to recent analysis (citing Foodpairing research), 85% of product launches fail within two years, with big CPG innovations failing even more often.

Why traditional foresight fails at today’s pace

Most innovation teams rely on sporadic trend spotting. They gather insights quarterly, compile reports, and try to extract strategic direction from fragmented signals. This creates three critical gaps:

- Reactive positioning becomes the default: By the time quarterly reports surface a trend, competitors may already be moving on it. Some companies don’t even consider following a new trend until an innovative competitor starts to hurt their business. By then, it’s already too late.

- Signal overwhelm paralyses decision-making: Teams get buried in data without clear methods to separate promising technologies from noise. R&D teams must still collect consumer feedback, prepare regulatory compliance data, and manage product testing. Without strategic direction on which technologies to prioritize, these activities become scattered across too many possibilities.

- Generic tools substitute for specialised insight: When overwhelmed, teams reach for whatever tools are available, even when they’re designed for different jobs.

According to InnoLead’s March 2025 survey of 105 R&D professionals, the top AI tools being used for innovation activities are general-purpose platforms like ChatGPT, Microsoft Copilot, and Claude. While they help with productivity, they weren’t designed for technology forecasting and lack the specialized focus on innovation data that R&D decisions require.

With continuous foresight you can see around corners

The key challenge for anyone steering product development today is no longer about identifying if technology is changing (historically, it always has), but how to harness that change proactively.

Traditionally, strategic foresight aims to recognise changes in your business environment at an early stage to prepare for the future. It’s a tool that expands awareness and helps make better decisions, making your organization more resilient and adaptable.

However, at the rate of change this space is seeing, a new, creative, and data-driven approach to foresight becomes necessary.

Why? Because if you are a packaging R&D leader in the CPG space, you need answers to four strategic questions:

- Which packaging technologies or materials are gaining traction?

- What’s improving fastest in terms of cost-performance or functionality?

- Which ones will actually scale given cost constraints and meet regulatory compliance?

- How do we know when a technology will be ready to replace what we use today?

This is where the concept of continuous foresight becomes important; and where GetFocus steps in.

With GetFocus, technology strategy teams can forecast the trajectory of emerging technologies based on how quickly they’re improving, and how likely they are to scale. And they can do so using independently verifiable signals from global invention data.

Estimating the Technology Improvement Rate

GetFocus identifies uses two key metrics derived from innovation data: Cycle Time and Knowledge Flow to estimate the Technology Improvement Rate (TIR).

- Cycle Time – this measures how frequently new generations or significant advancements of a technology are developed. It’s the time it takes to take a “step” forward in technological development. A shorter cycle time indicates a more rapidly evolving technology.

- Knowledge Flow – this quantifies the magnitude of improvement each new invention represents compared to previous ones. A high knowledge flow signifies a more significant leap in technological capability.

In practice, forecasting with GetFocus follows a four-step predictive process:

- Scout technologies → Uncover all relevant emerging technologies, eliminating blind spots.

- Map the landscape → Identify and curate the most significant inventions creating a focused dataset.

- Compare improvement rates → Our AI analyzes the dataset and tracks Cycle Time and Knowledge Flow to plot the TIR, showing how fast the technology improves over time.

- Deep-dive & act → Interact with the dataset via a chat interface to gain deeper insights, compare inventions, track competitors, and inform strategic actions.

With this four-step process, GetFocus transforms the overwhelming landscape of packaging innovations into actionable intelligence.

So, instead of sifting through thousands of inventions manually or relying on fragmented trend reports, R&D teams get a complete picture of where technologies are heading and when they’ll be ready for commercial deployment.

GetFocus transforms the overwhelming landscape of packaging innovations into actionable intelligence through this four-step approach. Instead of sifting through thousands of inventions manually or relying on fragmented trend reports, R&D teams get a complete picture of where technologies are heading and when they’ll be ready for commercial deployment.

Case-study: sustainable packaging

To prove this methodology works in practice, we applied it to sustainable packaging, a space where foresight failures hit particularly hard; and three converging pressures create urgency:

- Regulatory mandates like the EU’s 2030 Packaging and Packaging Waste Regulation (PPWR) which aims to make all packaging recyclable by 2030

- Consumer demand for environmental responsibility.

- Cost constraints that prevent expensive experimentation.

Teams need to predict which technologies will meet regulatory requirements, scale commercially, and improve fast enough to stay competitive.

What we discovered challenges conventional wisdom about sustainable packaging and reveals clear winners that most companies are missing.

Continuous foresight identifies clear winners in sustainable packaging

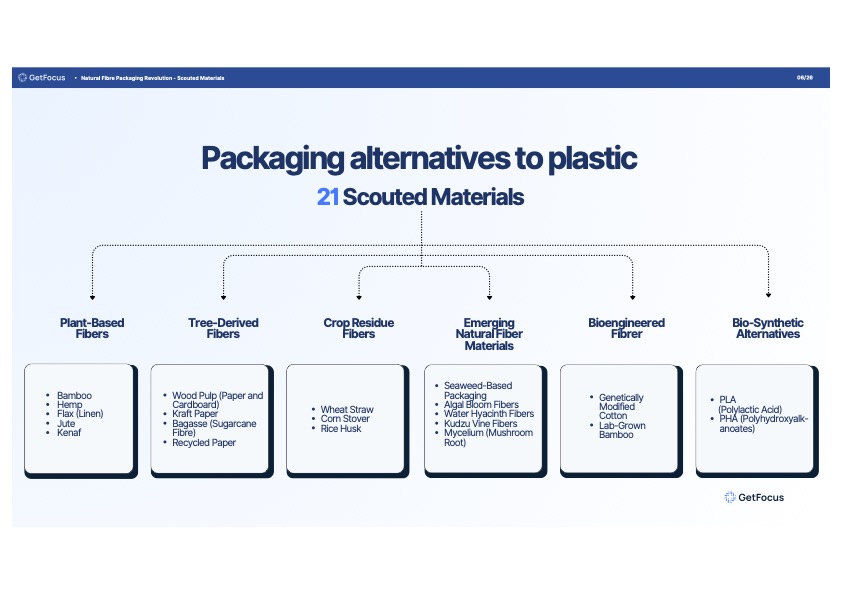

We analyzed 21 packaging alternatives across five categories: plant-based fibers, tree-derived fibers, crop residue fibers, emerging natural materials, and bio-synthetic alternatives. The analysis took our AI system just one day to complete what traditionally takes expert analysts 8 to 10 weeks.

PLA dominates with commercial readiness

PLA is a type of polyester made from fermented plant starch from corn, cassava, maize, sugarcane or sugar beet pulp. The sugar in these renewable materials are fermented and turned into lactic acid, when is then made into polylactic acid or PLA.

According to the TWI, PLA production uses 65% less energy than producing conventional plastics and generates 68% fewer greenhouse gases.

PLA leads with a 40% annual improvement rate and full commercial readiness (TRL 9).

It works with existing manufacturing systems, meets industrial composting standards, and offers the scalability that large CPG companies need. PLA has maintained this strong improvement trajectory since 2010, making it the most reliable choice for immediate deployment.

Bamboo leads natural fibres

Among plant-based options, bamboo shows the fastest improvement rate, nearly 35% annual improvement around 2022.

At TRL 8, it’s nearly ready for large-scale deployment. Bamboo’s exceptional mechanical strength, lightweight nature, and high cellulose content make it ideal for moulded fibre applications, while requiring no replanting, minimal water, and no pesticides.

Kudzu shows highest potential

Kudzu is a ‘mile a minute’ vine, it is an edible plant that can become become an invasive pest outside its native geography.

Despite being in early development (TRL 3), Kudzu Vine Fibres demonstrate a 45% improvement rate, the highest across all materials analyzed.

While current scalability is limited, the trajectory suggests strong future potential for transforming an invasive plant into valuable packaging material.

Continuous foresight identifies key geographies in the innovation race

China leads development in both top-performing materials, reflecting the presence of a coordinated national strategy to dominate next-generation sustainable packaging.

Within PLA, China seems to focus on bioplastics as a national priority—this is supported by substantial government investment in R&D aimed at reducing dependence on fossil-based plastics.

In addition, China is blessed with native bamboo abundance and therefore naturally invests in systematic development of processing capabilities. This dual leadership positions China to control the supply chains for the two most promising plastic alternatives.

Japan shows strong activity through major chemical companies, with Toray Industries leading PLA innovation, followed by Mitsui Chemicals.

More information

To read more about GetFocus

To download the white paper “Natural Fibre Packaging Revolution”